Frosh Finance: Budgets and Spending

One crucial aspect of your student’s college transition is money management. Some early conversations about budgeting can equip your student with the knowledge and tools to manage their finances and set them up for a successful and less stressful college experience. In this post, we are talking about your student’s living expenses (but if you are looking for information on budgeting for the cost of college, check out our budgeting overview post and our Paying for College video series).

Talking About the Expense Budget

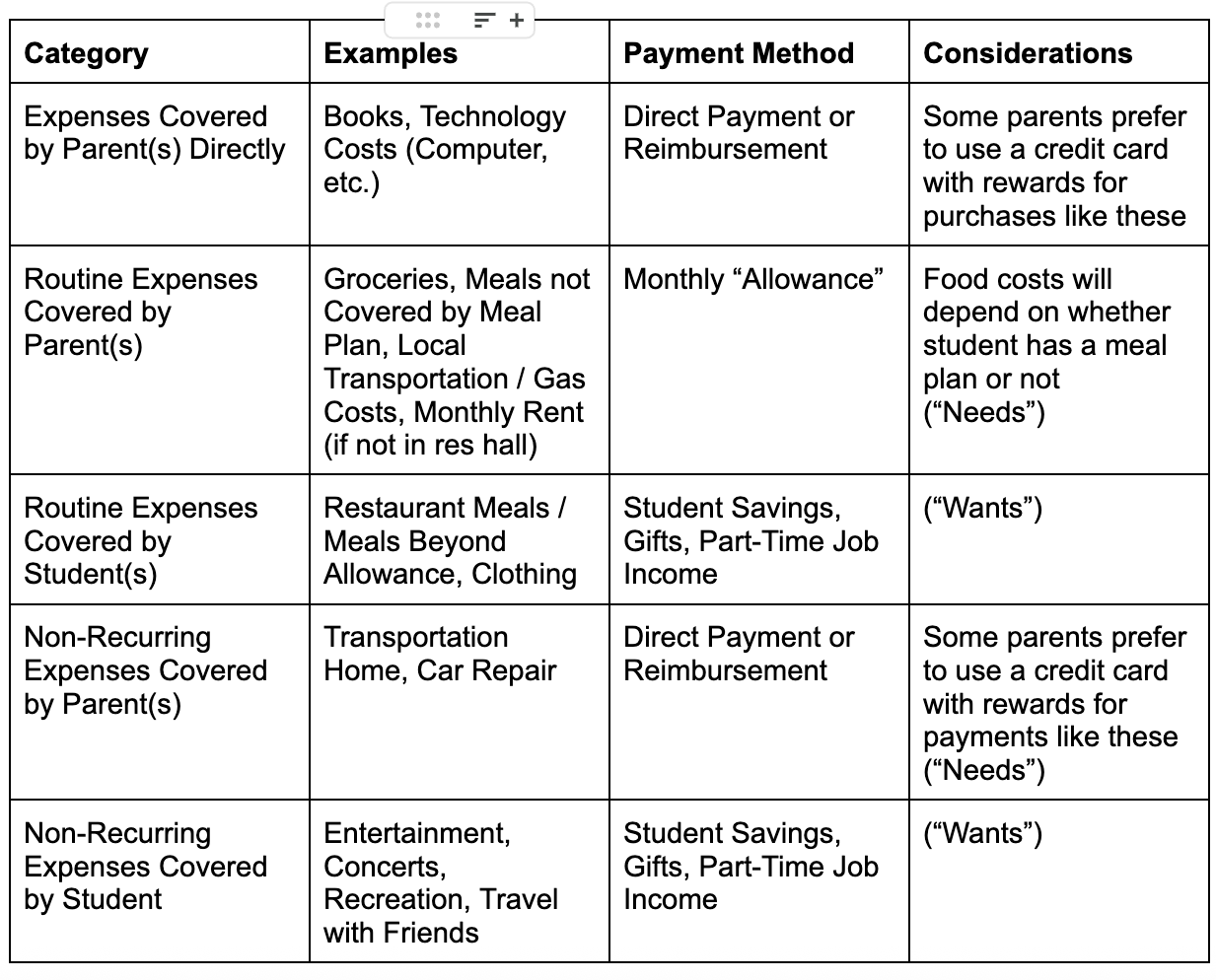

There is no one-size-fits-all approach to college expense budgets - it will be different for every family. A good starting point for most families is to list expense categories and put them in different buckets. Some examples of these are listed below, but remember that every family will have to determine what works best for them. (Tuition and housing costs are not included in this example as presumably that has been previously worked out.) The goal at this stage is to come up with a starting point, and then to review it a few months into the start of the semester to see if adjustments are needed. Once these categories are worked through, families will need to estimate costs and agree on who’s paying for what and from what bucket of money.

Managing Money

A common theme here is that things look different for different families - and we are just hoping to help get your wheels turning and the conversation started. One common approach - especially for freshmen - is for parents to give a monthly “allowance” in a set amount and for students to use this for the agreed upon purposes. If extra expenses come up, such as car maintenance or a damaged computer, families can discuss how to handle that cost outside of the “allowance.” The reason for this approach is that having a consistent amount of money every month and knowing what that money needs to cover is the best way for students to get used to living within a budget.

Rough Patches

It is impossible to predict costs with 100% certainty. Things might come up, such as the need to hire a tutor or purchase additional software to help with a class. But there are some things to look out for and talk about before school starts:

Peer pressure. Some students may find themselves around new friends who have larger budgets than they do. Normalizing saying “sorry, I can’t swing that this month” is a good thing. Talking about adjusting to the opposite situation - when friends have smaller budgets - is important too.

Personal Safety. Some parents make specific arrangements, such as telling their student that they can charge uber costs to a family credit card when they have any concern about safety, no questions asked (including avoiding driving with someone who has been drinking and avoiding other unsafe situations).

Online Spending. Make sure and discuss with your student that online spending needs to be categorized into buckets to determine who is responsible for what. For example, a family Spotify account might be available to your student at no additional cost, but Amazon costs would need to be handled individually. Again, this will differ for every family.

Credit Card Use. Many families add their student as an additional user on a credit card. This can make sense for a few reasons, including the ability to see expenses and the perk of rewards points that can be used for airline travel and the like. There are downsides though - including the fact that students using credit cards that are billed to their parents might not be as aware of costs as they would be if paying with a debit card. Families can address this by discussing the process ahead of time. For example, if they agree that the student can charge groceries and gas to their credit card, the student can track the amounts in a shared spreadsheet. (For more about credit cards and college students, see our post Link Post on Scams).

Food for Thought: It seems easy enough to tell students that if they come in under their expense budget for costs such as food (their “needs”), they can use that money for discretionary items (their “wants”). This might be a perfect plan for many students, but not for all. For example, if you are worried about your student skimping on healthy meals in order to have more discretionary funds available, you might want to be clear that food money is for food.

Life Preparation

Students who become accustomed to working with a budget in college tend to have less stress and have an easier transition into financial independence once they begin working. Perfection is not the goal, but talking about and following a budget helps families.