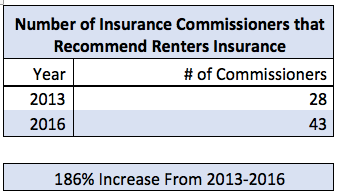

Part of our work at College Parents of America is to complete research work that helped identify trends important to college families. This summer our interns helped identify a trend where a growing number of state insurance commissioners recommend the purchase of renters insurance by college students. The data speaks for itself and the complete list of states can be found at the end of this article.

Nearly twice as many state insurance commissioners recommend renters insurance to college students in 2016 as did in 2013

In fact, the latest trend builds on an earlier report by the National Association of Insurance Commissioners (NAIC) that recommended college students consider the benefits of purchasing renters insurance. NAIC recommends that “college students renting an off-campus apartment or house while away at school should consider purchasing renters insurance to protect their personal property, such as a computer, electronics, bicycle or furniture, in the event that it is damaged, destroyed or stolen.”

While the NAIC notes that dependent students under 26 who live on campus are likely to have their belongings covered under a family homeowner’s policy, it is worth checking and recognizing that a high-deductible may reduce the value to a college student who needs to replace a stolen bicycle or backpack.

As we have published in earlier posts campus safety and crime data can be confusing. College Parents of America continues to advocate for more accurate reporting of campus safety and crime data. Until then, we remind college families that according to the 2014 FBI Uniform Crime Report indicated that 56,000 thefts occurred on college campuses. Data from the 2014 Clery Act reported by colleges, however, showed only 14,000. The difference is important. Campus crime often extends beyond campus boundaries while school based Clery data report crimes that occur on campus.

As a result, the plea by insurance commissioners is not only sincere, but likely prudent advice for college students and their families. Some particular Insurance Commissioners have made statements that further illustrate the value of renters insurance.

- Kansas Insurance Commissioner – Ken Selzer says:

“College students, don’t forget to add ‘insurance’ to the list of necessary items”

- Georgia Insurance Commissioner – Ralph T. Hudgens says:

“If your college student is moving away to school with expensive computers or other values, buying renter insurance is a smart move”

Insurance Commissioners 2016 |

||

States |

Recommend Renters Insurance |

|

| Alabama | Y | |

| Alaska | Y | |

| American Samoa | N | |

| Arizona | Y | |

| Arkansas | Y | |

| California | Y | |

| Colorado | Y | |

| Connecticut | Y | |

| Delaware | Y | |

| District of Columbia | Y | |

| Florida | N | |

| Georgia | Y | |

| Guam | N | |

| Hawaii | N | |

| Idaho | Y | |

| Illinois | Y | |

| Indiana | Y | |

| Iowa | Y | |

| Kansas | Y | |

| Kentucky | N | |

| Louisiana | Y | |

| Maine | Y | |

| Maryland | Y | |

| Massachusetts | Y | |

| Michigan | Y | |

| Minnesota | Y | |

| Mississippi | Y | |

| Missouri | Y | |

| Montana | Y | |

| Nebraska | Y | |

| Nevada | N | |

| New Hampshire | Y | |

| New Jersey | Y | |

| New Mexico | Y | |

| New York | Y | |

| North Carolina | Y | |

| North Dakota | Y | |

| Northern Mariana Islands | N | |

| Ohio | Y | |

| Oklahoma | Y | |

| Oregon | Y | |

| Pennsylvania | Y | |

| Puerto Rico | N | |

| Rhode Island | Y | |

| South Carolina | Y | |

| South Dakota | Y | |

| Tennessee | Y | |

| Texas | N | |

| Utah | Y | |

| U.S Virgin Islands | N | |

| Vermont | N | |

| Virginia | N | |

| Washington | Y | |

| West Virginia | N | |

| Wisconsin | Y | |

| Wyoming | Y | |