State Insurance Commissioners Recommend Renters Insurance for College Students

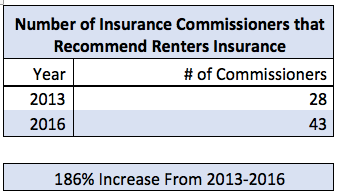

Nearly twice as many state insurance commissioners recommend renters insurance to college students in 2016 as did in 2013. In fact, the latest trend builds on an earlier report by the National Association of Insurance Commissioners (NAIC) that recommended college students consider the benefits of purchasing renters insurance. NAIC recommends that “college students renting an off-campus apartment or house while away at school should consider purchasing renters insurance to protect their personal property, such as a computer, electronics, bicycle or furniture, in the event that it is damaged, destroyed or stolen.”